Update from KHI News Service on 4/20/2016:

Kansas officials got the bad news they were expecting.

After reading the economic tea leaves and noting that state tax collections have been short of expectations in 11 of the past 12 months, the Consensus Revenue Estimating Group reduced its revenue projections for this budget year and the next by $228.6 million.

The situation is worse than that number suggests. The group lowered the amount it expects the state to collect in taxes over the next two years by nearly $350 million. But about $120 million in revenue transfers from the Kansas Department of Transportation and other agencies will be used to mask the depth of the projected shortfall.

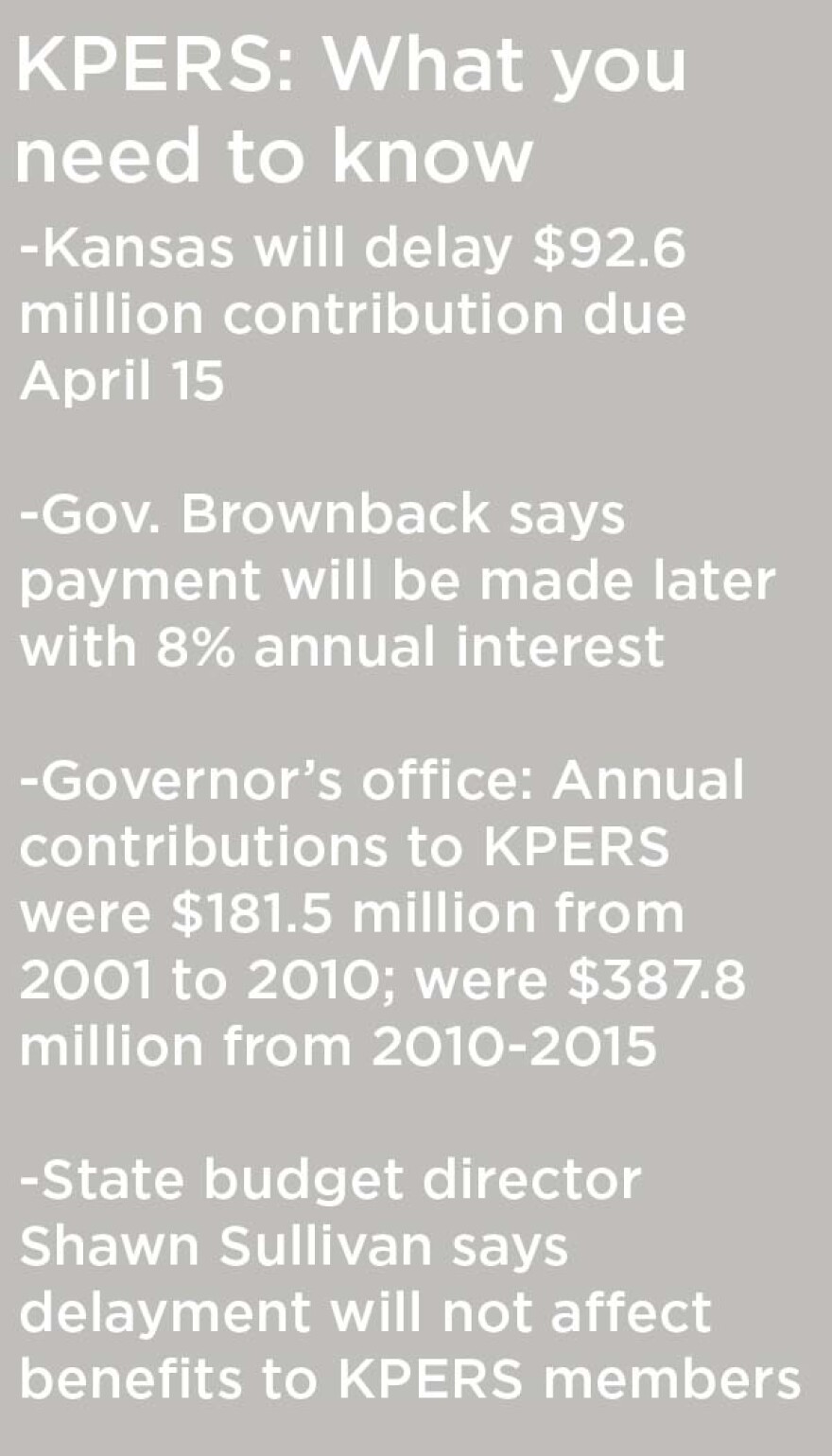

One of the solutions Gov. Sam Brownback proposed to make up for the deficit includes further delaying the $93 million payment into KPERS until fiscal year 2018.

Original story:

The state of Kansas has delayed its obligation to pay roughly $90 million into the pension system, which covers educators and most employees in state and local government. The quarterly payment was due today. And while there is still a question about how the money will be used, some financial experts say that the state is setting a risky precedent by not keeping its promise to state retirees.

Current estimates show Kansas will end the fiscal year $32 million short of a balanced budget. But by law, the budget has to be balanced to pass. Delaying the state’s required contribution into the pension plan is just one of the ways the Legislature is trying to eliminate the deficit.

Lawmakers okayed the delay with a provision that the state makes up the deferred payments, plus 8 percent annual interest. That’s to make up for what the funds could have earned if they had been invested.

“I suspect what they’re trying to do is move the required contribution into the next fiscal year so they can balance the budget this year and then they’ll deal with next fiscal year’s challenges at that time," says Keith Brainard, the Texas-based research director for the National Association of State Retirement Administrators.

Brainard is more familiar with pension plans than most people are with their own bank accounts, but he's a little skeptical of the current situation in Kansas.

“So the question you’re really asking is a fiscal question for the state and that is, ‘What is it that you, the state, are expecting to change between now and the time you would pay back this money?’” he says. “And you know, frankly, in a period when interest rates are as low as they are, it’s kind of an expensive loan the state is taking.”

The state does not consider the deferred payment a loan. According to state budget director Shawn Sullivan, it’s not about whether we call it a loan or something else.

"Either way, the payment will get paid back," he says. "Either because we decide not to use it as a budget balancing tool and it’s paid back this year, or, number two, we decide to use it for this year as a tool and then it’ll be paid back by September 30 of the next fiscal year.”

As far as paying back the money, Sullivan says other budget changes will have to be made down the line.

But until a decision is made whether or not to use the payments as a budget balancing tool, $90 million in required contributions is being held in ambiguous political limbo. If, for instance, the state decides to delay just a fraction of that $90 million--maybe just $50 million in payments--then it will have to find that $50 million somewhere else, Sullivan says--plus 8 percent annual interest.

Many critics of the government in Kansas put all of the blame for the current financial situation on Gov. Sam Brownback’s fiscal policies. But in the case of KPERS, that’s not totally true.

The Kansas pension plan only has about 67 percent of the funds it currently owes to future retirees. That’s partially because of a cap instituted by the Legislature in the early 90s that limits how much state and employee contributions can increase from year to year.

Ken Kriz, director of the Kansas Public Finance Center, says that has resulted in contributions that are consistently less than what they would need to be to keep funding levels where they need to be. Many researchers say 80 percent is a healthy funding level.

“And the state has just fallen further and further behind in terms of what it owes," he says.

Source: KPERS Valuation Report December 2014

KPERS has billions of dollars to cover retirement benefits for decades to come. For members who have been paying into KPERS, that money cannot legally be touched; that 67 percent just means that if everyone in the system retired today, the state would only have two-thirds of the money it has promised to employees.

Kriz says that in the short run, the contribution cap might have been a decent idea.

"But," he says, "to keep it in place this long, really, it has no intellectual or public finance justification.”

And when you consider that along with the delayed contributions from the state, complications from the economy and the 2012 tax cuts, the result is more than $9.5 billion that the state is obligated to pay retired Kansans that, at this point in time, it does not have.

Republican Rep. Don Hineman serves the 118th District in the northwest part of the state. He describes the controversy over KPERS funding as a perennial part of the legislative process.

“It seems like every year in some way we are impacting KPERS either to the positive or the negative side," he says.

Hineman says he sees the future of KPERS and those paying into it as positive. He says there is a plan in place to have KPERS in relatively good shape by 2020, but the plan depends on the government making payments.

“We are on the right track," he says. "We are moving in the right direction.”

That being said, he admits that with revenues as low as they are, he’s unsure of how the state expects to make this delayed payment, plus interest.

"I haven’t heard any specific rationale for how we might be able to make those payments. Some folks might be thinking that things will turn around and revenues will increase once we get into the new fiscal year," Hineman says. "If there is a plan, I don’t know what it is. My expectation is that our difficult financial circumstances are going to be with us for some time to come and that makes me very skeptical, and actually I believe that means we will have to do more cutting in other areas of the budget in order to give a higher priority to making those KPERS payments.”

So, at some point the state will have to pay what it has promised. And Keith Brainard with the National Association of Retirement Administrators says that’s what Kansans should be concerned about.

“Part of the problem is that the state has neglected the problem for so long, and of course the best thing the state could do is to stop digging a hole," he says. "I mean, what do they say, 'The first thing to do when you’re in a hole is to stop digging'? And the state needs to do that."

--

Follow Abigail Wilson on Twitter @AbigailKMUW.

To contact KMUW News or to send in a news tip, reach us at news@kmuw.org.